Essay

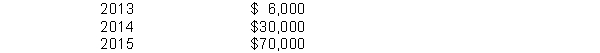

Derek Corporation was organized on January 1, 2013. During its first year, the corporation issued 40,000 preference shares with a $5 par value and 400,000 ordinary shares with a $1 par value. At December 31, the company declared the following cash dividends:  Instructions

Instructions

(a) Show the allocation of dividends to each class of shares, assuming the preference shares dividend is 4% and not cumulative.

(b) Show the allocation of dividends to each class of shares, assuming the preference shares dividend is 5% and cumulative.

(c) Journalize the declaration of the cash dividend at December 31, 2015 using the assumption of part (b).

Correct Answer:

Verified

Correct Answer:

Verified

Q36: An inexperienced accountant for Duran Corporation made

Q37: Voltaire Corporation issued 5,000 ordinary shares of

Q39: A corporation's own shares that have been

Q40: On January 1, 2014, Vannon Corporation had

Q42: Restricting retained earnings for the cost of

Q43: Book value per share is<br>A) the equity

Q44: Which of the following statements about a

Q45: On January 1, 2014, Dolan Corporation had

Q46: The following information is available for Ellis

Q96: Corporations sometimes segregate retained earnings into two