Essay

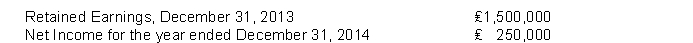

The following information is available for Piper Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was ₤15,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2014.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q214: The sale of ordinary shares below par<br>A)

Q215: Dividends in arrears on cumulative preference shares<br>A)

Q216: The par value of ordinary shares must

Q217: On January 2, 2011, Pacer Corporation issued

Q218: A 3-for-1 ordinary share split will increase

Q220: The following selected amounts are available for

Q221: On November 1, 2014, Huang Corporation's equity

Q222: The following accounts appear in the ledger

Q223: As part of a Careers in Accounting

Q224: During 2014, Pine Corporation had the following