Essay

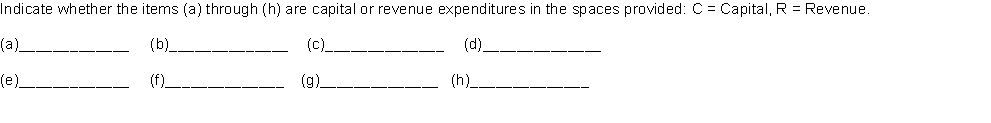

Kennett Company purchased a machine on January 1, 2014. In addition to the purchase price paid, the following additional costs were incurred: (a) sales tax paid on the purchase price, (b) transportation and insurance costs while the machinery was in transit from the seller, (c) personnel training costs for initial operation of the machinery, (d) annual city operating license, (e) major overhaul to extend the life of the machinery, (f) lubrication of the machinery gearing before the machinery was placed into service, (g) lubrication of the machinery gearing after the machinery was placed into service, and (h) installation costs necessary to secure the machinery to the building flooring.

Instructions

Correct Answer:

Verified

Correct Answer:

Verified

Q205: As a recent graduate of State University

Q278: Kingston Company purchased a piece of equipment

Q279: Recording depreciation each period is necessary in

Q280: Don's Copy Shop bought equipment for $120,000

Q282: Wesley Hospital installs a new parking lot.

Q284: During 2014, Stein Corporation reported net sales

Q285: On May 1, 2014, Pinkley Company sells

Q286: The depreciation method that applies a constant

Q287: Natural resources are<br>A) depreciated using the units-of-activity

Q288: On May 1, 2014, Pinkley Company sells