Essay

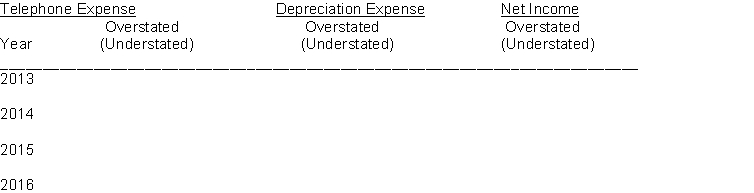

On January 1, 2012 Marsh Company purchased and installed a telephone system at a cost of ₤20,000. The equipment was expected to last five years with a residual value of ₤3,000. On January 1, 2013 more telephone equipment was purchased to tie-in with the current system for ₤12,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Marsh Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Depletion expense is computed by multiplying the

Q99: Mehring Company reported net sales of $450,000,

Q100: The cost of a purchased building includes

Q104: If a plant asset is retired before

Q105: Which of the following statements is correct?<br>A)

Q106: Depreciable cost is the<br>A) book value of

Q108: U.S. GAAP requires companies to use component

Q133: The cost of a patent should be

Q140: Goodwill<br>A) is only recorded when generated internally.<br>B)

Q175: The cost of land includes all of