Essay

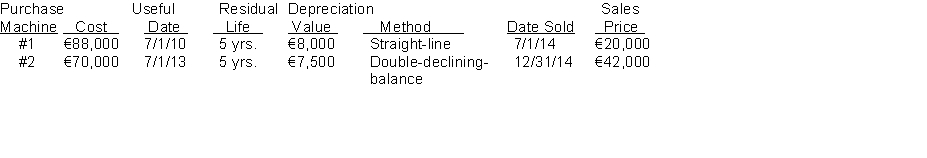

Hanshew's Lumber Mill sold two machines in 2014. The following information pertains to the two machines:  Instructions

Instructions

(a) Compute the depreciation on each machine to the date of disposal.

(b) Prepare the journal entries in 2014 to record 2014 depreciation and the sale of each machine.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Robin Company acquires a piece of land

Q10: Accumulated depreciation is reported on the statement

Q14: On July 4, 2014, Wyoming Mining Company

Q15: On January 1, 2014, Lakeside Enterprises purchased

Q16: A plant asset acquired on October 1,

Q33: Depreciation is a process of<br>A) asset devaluation.<br>B)

Q37: A loss on the exchange of plant

Q89: Yanik Company's delivery truck which originally cost

Q180: Each of the following is used in

Q304: Land improvements should be depreciated over the