Essay

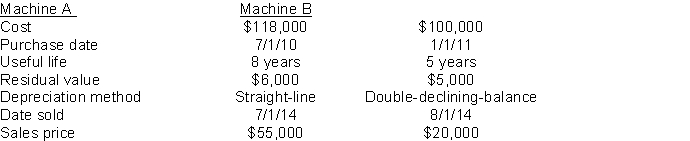

Tidwell Company sold the following two machines in 2014:  Instructions

Instructions

Journalize all entries required to update depreciation and record the sales of the two assets in 2014. The company has recorded depreciation on the machine through December 31, 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: In general,how does one determine whether or

Q85: How is a gain or loss on

Q105: Ordinary repairs which maintain operating efficiency and

Q208: The cost of demolishing an old building

Q323: Which one of the following items is

Q324: A truck costing $154,000 was destroyed when

Q326: DeLong Corporation purchased land adjacent to its

Q328: Development costs incurred after technological feasibility has

Q330: A company purchased factory equipment on April

Q331: Lowe Mining Company purchased a mine for