Essay

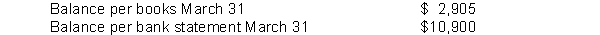

Dillman Food Store developed the following information in recording its bank statement for the month of March.  -------------------------------------------

-------------------------------------------

(1) Checks written in March but still outstanding $6,000.

(2) Checks written in February but still outstanding $2,800.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $5,000 plus $150 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Proper control for over-the-counter cash receipts includes<br>A)

Q44: Personnel who handle cash receipts should have

Q107: If a check correctly written and paid

Q109: Cash equivalents are currently reported as short-term

Q113: Gordon Company is unable to reconcile the

Q115: If a petty cash fund is established

Q141: Identify the internal control procedures applicable to

Q194: Control over cash disbursements is generally more

Q212: Identify which principle of internal control is

Q216: Electronic Funds Transfer (EFT) is a disbursement