Multiple Choice

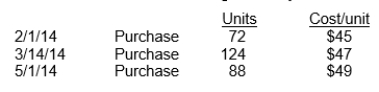

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $3,088

B) $3,392

C) $2,374

D) $2,160

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Goods out on consignment should be included

Q138: The first-in first-out (FIFO) inventory method results

Q201: Tucker Department Store utilizes the retail inventory

Q202: Euler Company made an inventory count on

Q203: A company just starting business made the

Q204: A major advantage of LIFO is that

Q207: Bueno Company's purchase and sales transactions for

Q208: Franco Company uses the FIFO inventory method.

Q209: Brocken Co. has the following data related

Q210: Flott Department Store prepares monthly financial statements