Multiple Choice

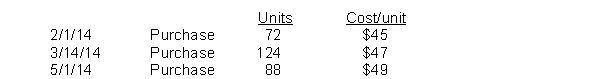

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

A) $9,764

B) $9,460

C) $3,392

D) $3,088

Correct Answer:

Verified

Correct Answer:

Verified

Q65: In applying the LIFO assumption in a

Q231: Inventory turnover is calculated as cost of

Q247: Quigley Company's records indicate the following information

Q248: Kershaw Bookstore had 800 units on hand

Q250: Wade Company prepares monthly financial statements and

Q251: Inventory items on an assembly line in

Q253: The following accounts are included in the

Q254: At May 1, 2014, Deitrich Company had

Q255: The accounting principle that requires that the

Q257: Oakley Supply Company reports net income of