Essay

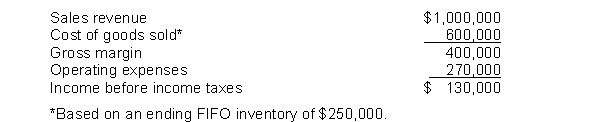

Eckert Company reported the following summarized annual data at the end of 2014:  The income tax rate is 30%. The controller of the company is considering a switch from FIFO to average-cost. He has determined that on an average-cost basis, the ending inventory would have been $220,000.

The income tax rate is 30%. The controller of the company is considering a switch from FIFO to average-cost. He has determined that on an average-cost basis, the ending inventory would have been $220,000.

Instructions

(a) Restate the summary information on an average-cost basis.

(b) What effect, if any, would the proposed change have on Eckert's income tax expense, net income, and cash flows?

(c) If you were an owner of this business, what would your reaction be to this proposed change?

Correct Answer:

Verified

*Ending inventory would be $30000 less ...

*Ending inventory would be $30000 less ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: In periods of rising prices, the inventory

Q48: Inventory is reported in the financial statements

Q49: If companies have identical inventory costs but

Q50: The following information was available from the

Q54: The lower-of-cost-or-net realizable value basis is an

Q55: Companies adopt different cost flow methods for

Q56: London Co. uses a periodic inventory system.

Q69: Under the gross profit method each of

Q79: The cost of goods available for sale

Q152: The more inventory a company has in