Short Answer

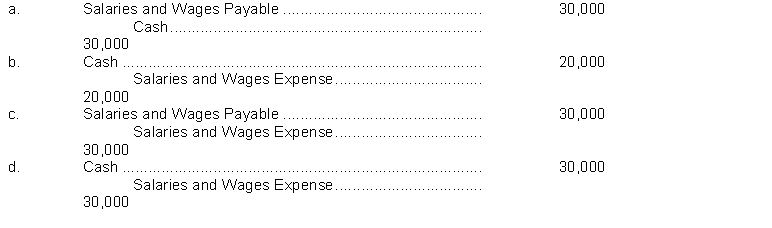

Farr Company paid the weekly payroll on January 2 by debiting Salaries and Wages Expense for $50,000. The accountant preparing the payroll entry overlooked the fact that Salaries and Wages Expense of $30,000 had been accrued at year end on December 31. The correcting entry is

Correct Answer:

Verified

Correct Answer:

Verified

Q128: On May 25, Carlin Company received a

Q131: A double rule applied to accounts in

Q133: On a classified statement of financial position,

Q135: IFRS requires that current assets be reported

Q137: The following items (in thousands) are taken

Q139: After closing entries are posted, the balance

Q140: The worksheet for Boone Mailing Center appears

Q141: After closing entries have been journalized and

Q177: The amounts appearing on an income statement

Q219: When constructing a worksheet accounts are often