Essay

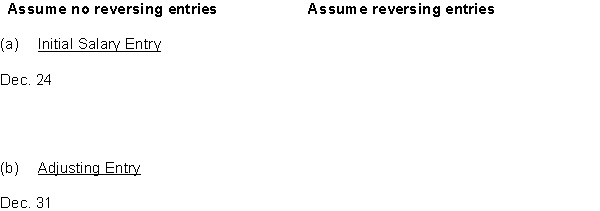

Transaction and adjustment data for Alcortt Company for the calendar year end is as follows:

1. December 24 (initial salary entry): ₤18,000 of salaries and wages earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries and wages earned between December 25 and December 31 are ₤3,000. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to ₤11,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.

(

Correct Answer:

Verified

Correct Answer:

Verified

Q71: The use of reversing entries<br>A) is a

Q114: A current asset is<br>A) the last asset

Q175: Intangible assets include each of the following

Q178: The following data (in thousands) is available

Q179: The temporary account balances ultimately wind up

Q180: The following selected account balances appear on

Q182: The following items (in thousands) are taken

Q186: The income statement for the year 2014

Q188: The Dividends account is a permanent account

Q236: A post-closing trial balance should be prepared<br>A)