Short Answer

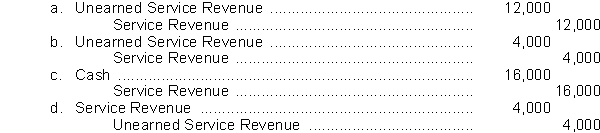

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Service Revenue when his clients pay him in advance. In June Mike collected $16,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Correct Answer:

Verified

Correct Answer:

Verified

Q91: An accounting period that is one year

Q142: Cara, Inc. purchased a building on January

Q143: Trench and Fog Garment Company purchased equipment

Q144: Ramona's Music School borrowed $30,000 from the

Q145: Pen & Stamp is a manufacturing company

Q148: Information that is presented in a clear

Q150: Action Real Estate received a check for

Q155: In a service-type business, revenue is considered

Q212: In general adjusting entries are required each

Q224: The cost of a depreciable asset less