Essay

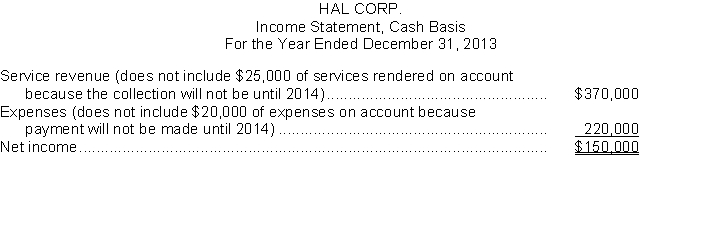

Hal Corp. prepared the following income statement using the cash basis of accounting:  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $2,400. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with IFRS. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Correct Answer:

Verified

(a)  Service revenue should include the ...

Service revenue should include the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: The balance in the Prepaid Rent account

Q73: The adjusting entry at the end of

Q82: If a resource has been consumed but

Q110: Prepaid expenses are<br>A) paid and recorded in

Q148: A company's calendar year and fiscal year

Q280: Prepare adjusting entries for the following transactions.

Q284: Niagara Corporation purchased a one-year insurance policy

Q286: A contra account found on the statement

Q287: The total amount of debits on the

Q290: The adjusted trial balance of Rocky Acre