Essay

Wham Company accumulates the following adjustment data at December 31.

1. Revenue of $800 collected in advance has been earned.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $450 has expired.

4. Supplies of $550 have been used.

5. Revenue earned but unbilled total $750.

6. Utility expenses of $400 are unpaid.

7. Interest of $150 has accrued on a note payable.

Instructions

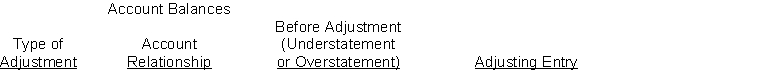

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (expense/asset, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $12,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A business pays weekly salaries of $30,000

Q100: On January 1, 2013, Grills and Grates

Q102: Betty Carson has performed $500 of accounting

Q104: The following ledger accounts are used by

Q105: The adjusted trial balance of C.S. Financial

Q108: Which one of the following is not

Q155: Accrued revenues are amounts recorded and received

Q226: Consistent use of the same accounting principles

Q227: The cash basis of accounting is not

Q235: If a business has received cash in