Essay

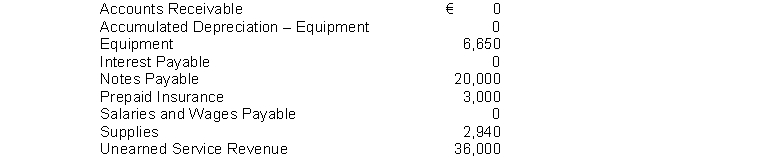

Ben Cartwright Pest Control has the following balances in selected accounts on December 31, 2014.  All of the accounts have normal balances. The information below has been gathered at December 31, 2014.

All of the accounts have normal balances. The information below has been gathered at December 31, 2014.

1. Depreciation on the equipment for 2014 is €1,250.

2. Ben Cartwright Pest Control borrowed €20,000 by signing a 6%, one-year note on July 1, 2014.

3. Ben Cartwright Pest Control paid €3,000 for 12 months of insurance coverage on October 1, 2014.

4. Ben Cartwright Pest Control pays its employees total salaries of €10,000 every Monday for the preceding 5-day week (Monday-Friday). On Monday, December 27, 2014, employees were paid for the week ending December 24, 2014. All employees worked the five days ending December 31, 2014.

5. Ben Cartwright Pest Control performed disinfecting services for a client in December 2014. The client will be billed €3,000.

6. On December 1, 2014, Ben Cartwright Pest Control collected €36,000 for disinfecting processes to be performed from December 1, 2014, through May 31, 2015.

7. A count of supplies on December 31, 2014, indicates that supplies of €750 are on hand.

Instructions

Prepare in journal form with explanations, the adjusting entries for the seven items listed for Ben Cartwright Pest Control.

Correct Answer:

Verified

Correct Answer:

Verified

Q94: If unearned revenues are initially recorded in

Q99: If prepaid costs are initially recorded as

Q115: Under accrual-basis accounting<br>A) cash must be received

Q116: Southwestern City College sold season tickets for

Q117: If a business has several types of

Q118: As a result of the revenue recognition

Q121: You and the CEO of your company

Q122: International Financial Reporting Standards (IFRS) include a

Q123: At December 31, 2014, before any year-end

Q208: Depreciation expense for a period is an