Essay

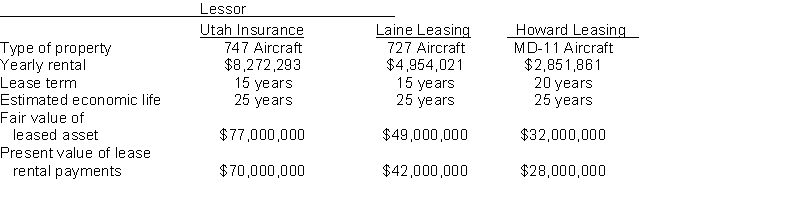

Presented below are three different aircraft lease transactions that occurred for Western Airways in 2014. All the leases start on January 1, 2014. In no case does Western receive title to the aircraft during or at the end of the lease period; nor is there a bargain purchase option.  Instructions

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2014?

(c) How should the lease transaction with Laine Leasing be recorded in 2014?

Correct Answer:

Verified

(a) The Utah Insurance lease is a financ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Which one of the following payroll taxes

Q49: The amount you must deposit now in

Q50: Chang Company earns 12% on an investment

Q52: Proving the postings of a single-column purchases

Q72: In computing the present value of an

Q122: Which of the following would not be

Q172: When determining the proceeds received when issuing

Q179: An operating lease transfers substantially all the

Q180: Sasser Company uses a sales journal, a

Q196: The effective federal unemployment tax rate is