Essay

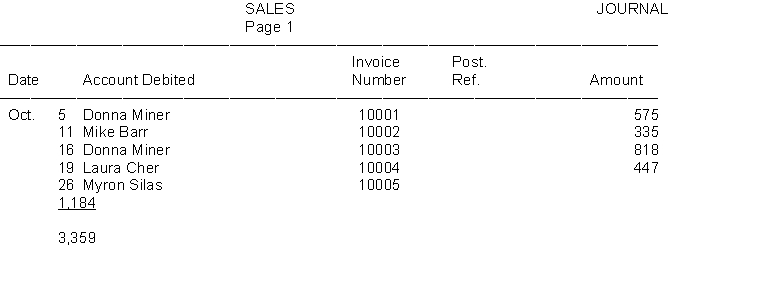

Easton Company began business on October 1. The sales journal, as it appeared at the end of the month, follows:

1. Open general ledger T-accounts for Accounts Receivable (No. 112) and Sales Revenue (No. 401) and an accounts receivable subsidiary T-account ledger with an account for each customer. Make the appropriate postings from the sales journal. Fill in the appropriate posting references in the sales journal above.

2. Prove the accounts receivable subsidiary ledger by preparing a schedule of accounts receivable.

Correct Answer:

Verified

2. SCHED...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2. SCHED...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following employees would likely

Q11: Which one of the following payroll taxes

Q12: An employee's time card is used to

Q49: A single-column purchases journal is used to

Q68: A subsidiary ledger is<br>A) used in place

Q187: FICA taxes do not provide workers with<br>A)

Q196: The effective federal unemployment tax rate is

Q198: The factor 1.0609 is taken from the

Q200: At the end of the month, the

Q205: Below are some typical transactions incurred by