Essay

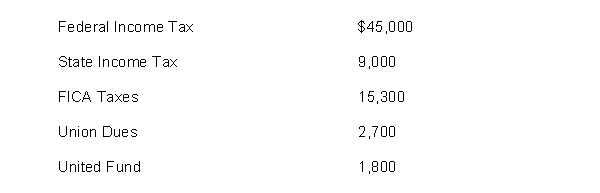

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and the employer's payroll tax expense on the payroll for January 15.

Correct Answer:

Verified

(To record employer...

(To record employer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Control over timekeeping does not include<br>A) having

Q19: Luis Rodriguez wants to buy a car

Q31: A lease where the intent is temporary

Q67: Circle the correct answer to each situation.

Q68: Diane Lane earns a salary of $9,500

Q70: If the present value of lease payments

Q71: Assuming a FICA tax rate of 7.65%

Q73: If an event may become an actual

Q88: The payroll is paid by the<br>A) personnel

Q138: Transactions that cannot be entered in a