Essay

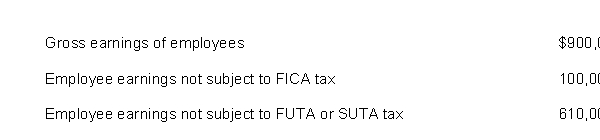

Banner Company had the following payroll data for the year:  Assume the following:

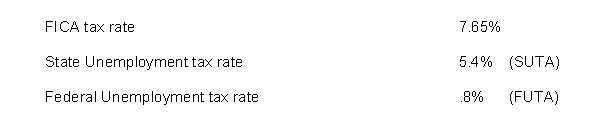

Assume the following:  Instructions

Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: If merchandise from a cash sale is

Q35: Larson Company has twenty employees who each

Q63: If a company purchases merchandise for cash

Q63: The future value of a single amount

Q116: If a transaction cannot be recorded in

Q120: Employees claim allowances for income tax withholding

Q180: Sasser Company uses a sales journal, a

Q181: Assuming a FICA tax rate of 7.65%

Q183: A company will incur product repair costs

Q189: 29<br>Warren Company's payroll for the week ending