Essay

30

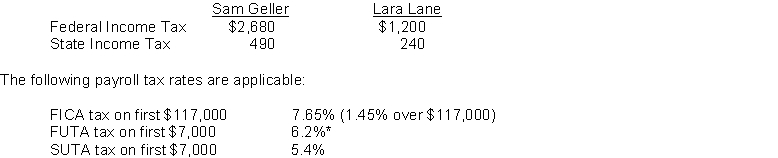

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The state unemployment tax rate is usually

Q3: The future value of an annuity factor

Q10: DMV leases a building for 20 years.

Q66: Contingent liabilities should be recorded in the

Q76: Entries in the cash payments journal are

Q83: Cross-footing a cash receipts journal means<br>A) the

Q116: The tax that is paid equally by

Q133: A finance lease requires the lessee to

Q137: Pleasant Company has decided to begin accumulating

Q142: Match the items below by entering the