Essay

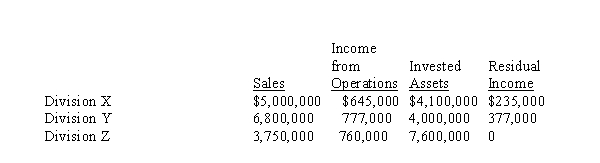

The sales, income from operations, invested assets, and residual income for each division of Marcus Company are as follows:  Determine the minimum rate of return for invested assets.

Determine the minimum rate of return for invested assets.

Correct Answer:

Verified

Division X: $645,000 - $4,100,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Which of the following is a disadvantage

Q33: 4. What is the profit margin?<br>A) 20%<br>B)

Q40: How much will Division 6's income from

Q47: Use this information for ABC Corporation to

Q68: What is the profit margin for Division

Q77: Miller's Quarter Horse Company has sales of

Q90: Use this information for ABC Corporation to

Q118: Service department charges are similar to the

Q132: The primary accounting tool for controlling and

Q218: The profit center income statement should include