Short Answer

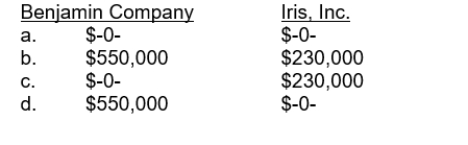

Benjamin Company uses IFRS, while Iris, Inc. uses U.S. GAAP, for their externalfinancial reporting. On January 16, 2015, both companies settled lawsuits relating toindustrial accidents that occurred in 2013. Benjamin Company paid $550,000 and Iris, Inc.paid $230,000. Assuming that no accrual had been previously made, what amount of lossshould be reported on the income statement for the year ended December 31, 2014 foreach company?

Correct Answer:

Verified

Correct Answer:

Verified

Q94: The SEC requires that companies report to

Q95: Interim reporting.Interim financial reporting has become an

Q96: If Benjamin Company and Iris, Inc. are

Q97: Identifiable assets for the 4 industry

Q98: If 10 percent or more of company

Q100: Unruh Corp. and its divisions are engaged

Q101: Management's discussion and analysis section covers three

Q102: Rondelli Manufacturing Company employs a standard cost

Q103: For interim financial reporting, an extraordinary gain

Q104: A company that uses the last-in, first-out