Multiple Choice

Use the following information for questions 44 and 45.

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

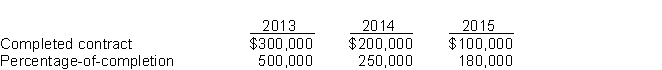

Income before taxes under both the methods for the past three years appears below.

-What amount will be debited to Construction in Process account, to record the change at beginning of 2015?

A) $250,000

B) $100,000

C) $150,000

D) $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: On January 1, 2014, Janik Corp. acquired

Q17: If an FASB standard creates a new

Q18: When it is impossible to determine whether

Q19: On January 1, 2015, Frost Corp. changed

Q20: An example of a correction of an

Q22: Vance Company reported net incomes for a

Q23: Companies report changes in accounting estimates retrospectively.

Q24: Is the following exception applicable to IFRS

Q25: A company changes from percentage-of-completion to completed-contract

Q26: On December 31, 2015, Grantham, Inc. appropriately