Multiple Choice

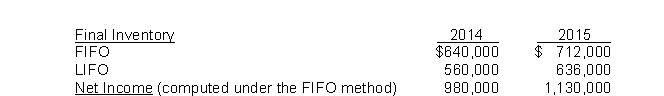

Heinz Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based on the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based on the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

A) $1,170,000.

B) $1,130,000.

C) $1,054,000.

D) $1,050,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: When a company decides to switch from

Q47: Use the following information for questions 64

Q48: Counterbalancing errors are those errors that take

Q49: Retrospective application is considered impracticable if a

Q50: Which of the following is (are) the

Q52: Which of the following statements is correct?<br>A)

Q53: When companies make changes that result in

Q54: Mars, Inc. follows IFRS for its external

Q55: A change in accounting principle is a

Q56: Companies must make correcting entries for noncounterbalancing