Multiple Choice

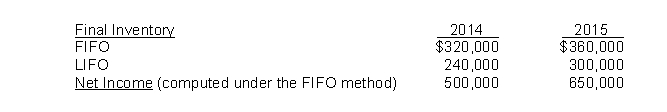

Lanier Company began operations on January 1, 2014, and uses the FIFO method in costing its raw material inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:  Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

Based upon the above information, a change to the LIFO method in 2015 would result in net income for 2015 of

A) $590,000.

B) $650,000.

C) $670,000.

D) $710,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The estimated life of a building that

Q34: During 2014, a textbook written by

Q35: Companies account for a change in depreciation

Q36: Joseph Co. began operations on January 1,

Q37: Presenting consolidated financial statements this year when

Q39: Use the following information for questions 47

Q40: IFRS requires that changes in estimate be

Q41: Ben, Inc. follows IFRS for its external

Q42: Errors in financial statements result from mathematical

Q43: On December 31, 2015 Dean Company changed