Multiple Choice

Use the following information for questions 55 and 56.

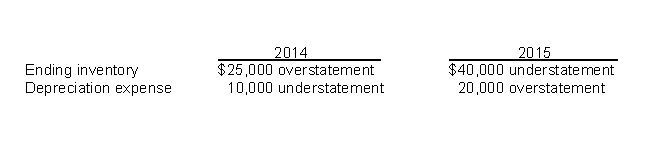

Armstrong Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/14 and 12/31/15 contained the following errors:

-Assume that the 2014 errors were not corrected and that no errors occurred in 2013. By what amount will 2014 income before income taxes be overstated or understated?

A) $35,000 overstatement

B) $15,000 overstatement

C) $35,000 understatement

D) $15,000 understatement

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Accrued salaries payable of $51,000 were not

Q2: Both IFRS and U.S. GAAP allow that

Q3: Use the following information for questions 44

Q5: IFRS requires that any indirect effect of

Q6: When changing from the equity method to

Q7: Haystack, Inc. owns 30% of the

Q8: Which of the following is not a

Q9: Which of the following disclosures is required

Q10: On January 1, 2012, Neal Corporation acquired

Q11: Counterbalancing errors do not include<br>A) errors that