Multiple Choice

Use the following information for questions 61 through 63.

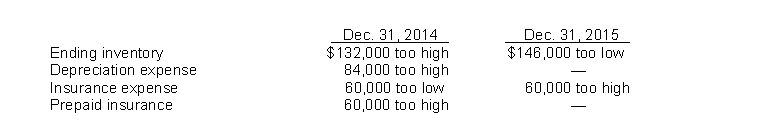

Bishop Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 con- tained the following errors:  In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Bishop's 2015 net income is

A) understated by $366,800.

B) understated by $234,800.

C) overstated by $117,200.

D) overstated by $249,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: On January 1, 2012, Neal Corporation acquired

Q11: Counterbalancing errors do not include<br>A) errors that

Q12: A company changes from the straight-line method

Q13: Changing the cost or equity method of

Q14: Use the following information for questions 66

Q16: On January 1, 2014, Janik Corp. acquired

Q17: If an FASB standard creates a new

Q18: When it is impossible to determine whether

Q19: On January 1, 2015, Frost Corp. changed

Q20: An example of a correction of an