Multiple Choice

Use the following information for questions 61 through 63.

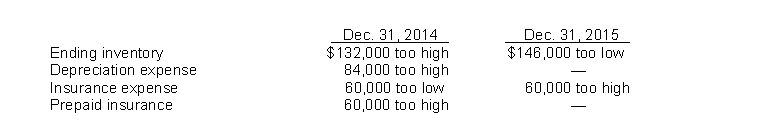

Bishop Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 con- tained the following errors:  In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on the amount of Bishop's working capital at December 31, 2015 is understated by

A) $390,800.

B) $306,800.

C) $174,800.

D) $114,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Black, Inc. is a calendar-year corporation whose

Q79: One of the disclosure requirements for a

Q80: For each of the following items, indicate

Q81: On January 1, 2010, Powell Company purchased

Q82: On January 1, 2012, Piper Co., purchased

Q84: Under IFRS, the direct effects of changes

Q85: Discuss the accounting procedures for and illustrate

Q86: An indirect effect of an accounting change

Q87: Dyke Company's net incomes for the past

Q88: Which type of accounting change should always