Short Answer

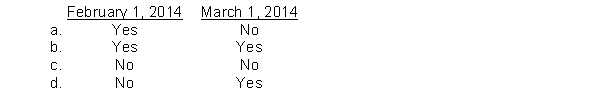

A corporation was organized in January 2014 with authorized capital of $10 par value common stock. On February 1, 2014, shares were issued at par for cash. On March 1, 2014, the corporation's attorney accepted 7,000 shares of common stock in settlement for legal services with a fair value of $90,000. Additional paid-in capital would increase on

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Layne Corporation had the following information in

Q11: Stock dividends.Describe the journal entry for a

Q12: Lump sum issuance of stock.Parker Corporation has

Q13: Which of the following best describes a

Q14: Presented below is information related to Wyrick

Q16: Which one of the following disclosures should

Q17: Cumulative preferred dividends in arrears should be

Q18: The cumulative feature of preferred stock<br>A) limits

Q19: Stockholders' Equity.Indicate the effect of each of

Q20: Younger Company has outstanding both common stock