Multiple Choice

Use the following information for questions 60 through 62:

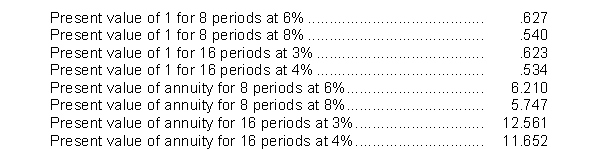

On January 1, 2014, Ellison Co. issued eight-year bonds with a face value of $4,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are:

-The present value of the principal is

A) $2,136,000.

B) $2,160,000.

C) $2,492,000.

D) $2,508,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Use the following information for questions *103

Q43: The printing costs and legal fees associated

Q44: Under IFRS, all troubled-debt restructurings are accounted

Q45: Reich, Inc. issued bonds with a maturity

Q46: On its December 31, 2014 balance sheet,

Q48: Long-term debt that matures within one year

Q49: "In-substance defeasance" is a term used to

Q50: In a troubled debt restructuring in which

Q51: A company issues $10,000,000, 7.8%, 20-year bonds

Q52: U.S. GAAP and IFRS have the same