Short Answer

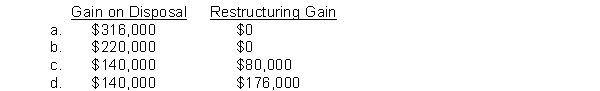

Eddy Co. is indebted to Cole under a $800,000, 12%, three-year note datedDecember 31, 2013. Because of Eddy's financial difficulties developing in 2015, Eddy owed accrued interest of $96,000 on the note at December 31, 2015. Under a troubled debt restructuring, on December 31, 2015, Cole agreed to settle the note and accrued interest for a tract of land having a fair value of $720,000. Eddy's acquisition cost of the land is $580,000. Ignoring income taxes, on its 2015 income statement Eddy should report as a result of the troubled debt restructuring

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A company issues $20,000,000, 7.8%, 20-year bonds

Q35: Carr Corporation retires its $300,000 face value

Q36: Bond issues that mature in installments are

Q37: A company issues $10,000,000, 7.8%, 20-year bonds

Q38: A company issues $10,000,000, 7.8%, 20-year bonds

Q40: On January 2, 2014, a calendar-year corporation

Q41: The cash paid for interest will always

Q42: Use the following information for questions *103

Q43: The printing costs and legal fees associated

Q44: Under IFRS, all troubled-debt restructurings are accounted