Essay

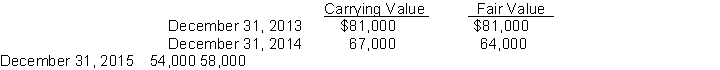

Harper Company commonly issues long-term notes payable to its various lenders. Harper has had a pretty good credit rating such that its effective borrowing rate is quite low (less than 8% on an annual basis). Harper has elected to use the fair value option for the long-term notes issued to Barclay's Bank and has the following data related to the carrying and fair value for these notes.

Instructions

(a) Prepare the journal entry at December 31 (Harper's year-end) for 2013, 2014, and 2015 to record the fair value option for these notes.

(b) At what amount will the note be reported on Harper's 2014 balance sheet?

(c) What is the effect of recording the fair value option on these notes on Harper's 2015 income?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1, 2014, Crown Company sold

Q5: The interest rate of variable-rate mortgages is

Q6: Putnam Company's 2014 financial statements contain the

Q7: If the market rate is greater than

Q8: On January 1, 2008, Hernandez Corporation issued

Q10: The following information applies to both questions

Q11: A company issues $20,000,000, 7.8%, 20-year bonds

Q12: The times interest earned ratio is computed

Q13: In a troubled debt restructuring, the loss

Q14: In the recent year Hill Corporation had