Short Answer

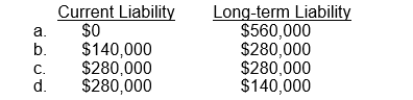

On January 1, 2012, Bacon Co. leased a building to Horner Corp. for a ten-year term at an annual rental of $140,000. At inception of the lease, Bacon received $560,000 covering the first two years' rent of $280,000 and a security deposit of $280,000. This deposit will not be returned to Horner upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $560,000 should be shown as a current and long-term liability, respectively, in Bacon's December 31, 2012 balance sheet?

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Flavor Food Company distributes to consumers coupons

Q76: The ability to consummate the refinancing of

Q77: Use the following information for questions 127,

Q78: Under IFRS, which of the following is

Q79: Contingent liabilities are not reported in the

Q81: A company offers a cash rebate of

Q82: Which of the following is not a

Q83: Use the following information for questions 127,

Q84: An electronics store is running a promotion

Q85: Overton Corporation, a manufacturer of household paints,