Multiple Choice

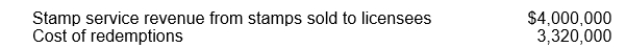

Core Trading Stamp Co. records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees. Core's past experience indicates that only 75% of the stamps sold to licensees will be redeemed. Core's liability for stamp redemptions was $5,000,000 at December 31, 2013. Additional information for 2014 is as follows:  If all the stamps sold in 2014 were presented for redemption in 2015, the redemption cost would be $3,000,000. What amount should Core report as a liability for stamp redemptions at December 31, 2014?

If all the stamps sold in 2014 were presented for redemption in 2015, the redemption cost would be $3,000,000. What amount should Core report as a liability for stamp redemptions at December 31, 2014?

A) $8,320,000.

B) $5,680,000.

C) $3,930,000.

D) $4,680,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q119: On September 1, 2014, Halley Co. issued

Q120: Under what conditions is an employer required

Q121: Contingent assets need not be disclosed in

Q122: Where is debt callable by the creditor

Q123: Each of the following are included in

Q125: Use the following information for questions 110

Q126: On January 3, 2014, Benton Corp. owned

Q127: Valley, Inc., is a retail store operating

Q128: What is a discount as it relates

Q129: A company has not declared a dividend