Essay

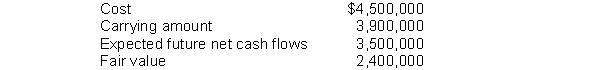

Impairment of copyrights.Presented below is information related to copyrights owned by Wamser Corporation at December 31, 2014.  Assume Wamser will continue to use this asset in the future. As of December 31, 2014, the copyrights have a remaining useful life of 5 years.

Assume Wamser will continue to use this asset in the future. As of December 31, 2014, the copyrights have a remaining useful life of 5 years.

Instructions

(a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2014.

(b) Prepare the journal entry to record amortization expense for 2015.

(c) The fair value of the copyright at December 31, 2015 is $2,500,000. Prepare the journal entry (if any) necessary to record this increase in fair value.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: If a company constructs a laboratory building

Q125: Which of the following costs incurred internally

Q126: IFRS permits some capitalization of internally generated

Q127: IFRS allows reversal of impairment losses when<br>A)

Q128: The primary IFRS related to intangible assets

Q131: Which of the following is not an

Q132: On January 2, 2014, Klein Co. bought

Q133: Which characteristic is not possessed by intangible

Q134: Costs in the research phase are always

Q135: When a company develops a trademark the