Multiple Choice

Use the following information for questions 84 and 85:

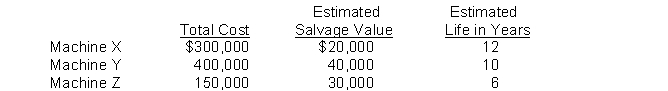

A schedule of machinery owned by Micco Co. is presented below:  Micco computes depreciation by the composite method.

Micco computes depreciation by the composite method.

-The composite rate of depreciation (in percent) for these assets is

A) 8.94.

B) 10.59.

C) 8.57.

D) 15.56.

Correct Answer:

Verified

Correct Answer:

Verified

Q112: Even though IFRS does not employ the

Q113: Asset revaluations are permitted under IFRS and

Q114: Definitions.<br>Provide clear, concise answers for the following.<br>1.

Q115: IFRS uses a fair value test to

Q116: Which of the following is true of

Q118: Each year a company has been investing

Q119: Depreciation accounting<br>A) provides funds.<br>B) funds replacements.<br>C) retains

Q120: In measuring an impairment loss, IFRS uses<br>A)

Q121: Reserve recognition accounting<br>A) is presently the generally

Q122: Rock Company purchased a depreciable asset for