Multiple Choice

Use the following information for questions 84 and 85:

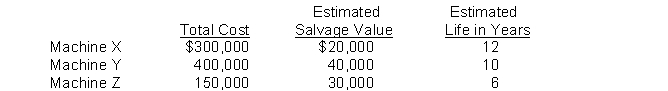

A schedule of machinery owned by Micco Co. is presented below:  Micco computes depreciation by the composite method.

Micco computes depreciation by the composite method.

-The composite life (in years) for these assets is

A) 15.6.

B) 8.6.

C) 8.9.

D) 10.0.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Calculate depreciation.<br>A machine cost $800,000 on April

Q6: Which of following is not a similarity

Q7: Asset depreciation and disposition.<br>Answer each of the

Q8: The accounting exchanges of nonmonetary assets has

Q9: Jasmine Company purchased a depreciable asset for

Q11: Questions 7 through 10 are based on

Q12: Slotkin Products purchased a machine for $39,000

Q13: Depletion allowance.<br>Mareos Company purchased for $3,800,000 a

Q14: Use the following information for questions 111

Q15: The asset turnover ratio is computed by