Short Answer

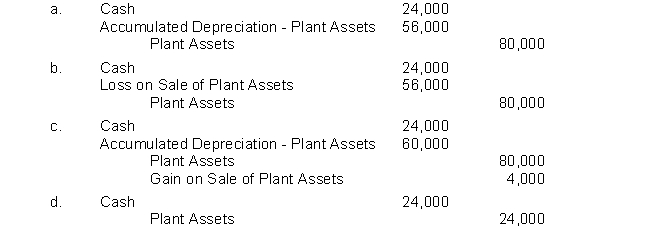

If Labor, Inc. uses the composite method and its composite rate is 7.5% per year, what entry should it make when plant assets that originally cost $80,000 and have been used for 10 years are sold for $24,000?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q53: On July 1, 2014, Nowton Co. purchased

Q54: IFRS permits companies to carry assets at

Q55: Regis Inc. bought a machine on January

Q56: On January 3, 2013, Salazar Co. purchased

Q57: Ramos Co. purchased machinery that was installed

Q59: Carson Company purchased a depreciable asset for

Q60: If income tax effects are ignored, accelerated

Q61: Glow Co. purchased machinery on January 2,

Q62: Acceptable depreciation methods under IFRS include<br>A) Straight-line.<br>B)

Q63: On September 19, 2014, Markham Co. purchased