Short Answer

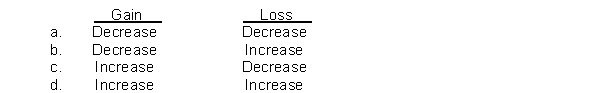

A plant asset with a five-year estimated useful life and no residual value is sold at the end of the second year of its useful life. How would using the sum-of-the-years'-digits method of depreciation instead of the double-declining balance method of depreciation affect a gain or loss on the sale of the plant asset?

Correct Answer:

Verified

Correct Answer:

Verified

Q16: True or False.<br>Place T or F in

Q17: Klayton Corporation purchased factory equipment that was

Q18: In 2014, Bargain shop reported net income

Q19: Depletion expense<br>A) is usually part of cost

Q20: Barton Corporation acquires a coal mine at

Q22: In 2014, Bargain shop reported net income

Q23: Intangible development costs and restoration costs are

Q24: Depreciation is a means of cost allocation,

Q25: Impairment.<br>Dolphin Company uses special strapping equipment in

Q26: Impaired assets held for disposal should be