Multiple Choice

Use the following information for questions 78 through 80.

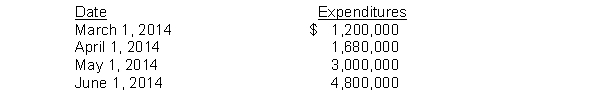

On March 1, 2014, Newton Company purchased land for an office site by paying $1,800,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction:  The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

-The actual interest cost incurred during 2014 was

A) $300,000.

B) $336,000.

C) $168,000.

D) $280,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q140: During self-construction of an asset by Richardson

Q141: During 2014, Bass Corporation constructed assets costing

Q142: Which of the following statements about involuntary

Q143: Danson Company, a company who uses IFRS

Q144: Miller Company, a company who uses IFRS

Q146: A plant site donated by a township

Q147: Consider each of the items below. Place

Q148: Gutierrez Company is constructing a building. Construction

Q149: Land was purchased to be used as

Q150: On April 1, Mooney Corporation purchased for