Multiple Choice

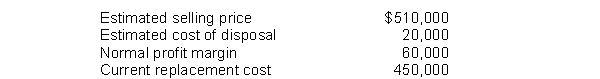

Ryan Distribution Co. has determined its December 31, 2014 inventory on a FIFO basis at $490,000. Information pertaining to that inventory follows:  Ryan records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2014, the loss that Ryan should recognize is

Ryan records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2014, the loss that Ryan should recognize is

A) $0.

B) $10,000.

C) $20,000.

D) $40,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: An inventory method which is designed to

Q63: Muckenthaler Company sells product 2005WSC for $40

Q64: Why might inventory be reported at sales

Q65: Use the following information for questions 114

Q66: Use the following information for questions 96

Q68: Inventory may be recorded at net realizable

Q69: According to FASB concepts statement No.6, purchase

Q70: The purpose of the "floor" in lower-of-cost-or-market

Q71: The inventory turnover ratio is computed by

Q72: At December 31, 2014, the following information