Essay

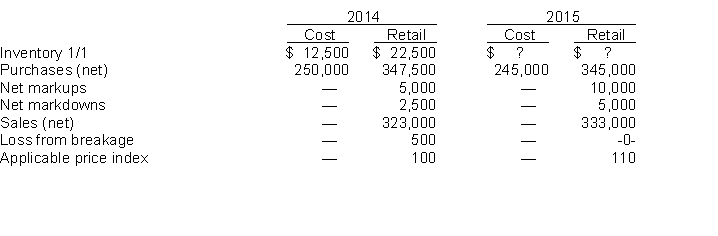

Retail LIFO.Klein Book Store uses the conventional retail method and is now considering converting to the LIFO retail method for the period beginning 1/1/15. Available information consists of the following:  Following is a schedule showing the computation of the cost of inventory on hand at 12/31/14 based on the conventional retail method.

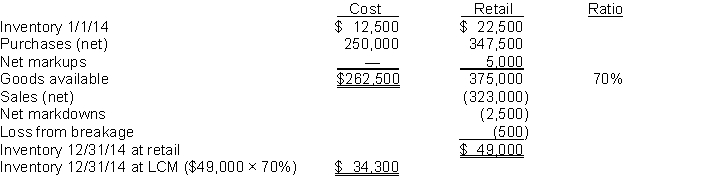

Following is a schedule showing the computation of the cost of inventory on hand at 12/31/14 based on the conventional retail method.

Instructions

(a) Prepare the journal entry to convert the inventory from the conventional retail to the LIFO retail method. Show detailed calculations to support your entry.

(b) Prepare a schedule showing the computation of the 12/31/15 inventory based on the LIFO retail method as adjusted for fluctuating prices. Without prejudice to your answer to

(a) above, assume that you computed the 1/1/15 inventory (retail value $49,000) under the LIFO retail method at a cost of $34,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q88: Use the following information for questions 125

Q89: In most situations, the gross profit percentage

Q90: Doran Realty Company purchased a plot of

Q91: Robust Inc. has the following information related

Q92: Goren Corporation had the following amounts, all

Q94: If a material amount of inventory has

Q95: During 2014, Larue Co., a manufacturer of

Q96: State Company manufactured a machine at a

Q97: The original cost of an inventory item

Q98: Which of the following is not a