Multiple Choice

Use the following information for questions 92 through 94.

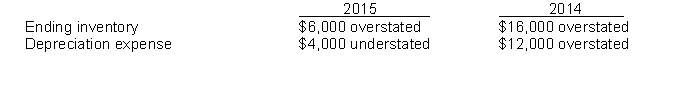

Hudson, Inc. is a calendar-year corporation. Its financial statements for the years 2015 and 2014 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2014, or December 31, 2015 and that no additional errors occurred in 2016. Ignoring income taxes, by how much will working capital at December 31, 2016 be overstated or understated?

A) $0

B) $ 4,000 overstated

C) $ 4,000 understated

D) $10,000 understated

Correct Answer:

Verified

Correct Answer:

Verified

Q135: Assuming no beginning inventory, what can be

Q136: Wise Company adopted the dollar-value LIFO method

Q137: Dollar-value LIFO techniques help protect LIFO layers

Q138: U.S. GAAP has less detailed rules related

Q139: In the context of dollar-value LIFO, what

Q141: The cost flow assumption adopted must be

Q142: Use the following information for questions 125

Q143: Green Co. received merchandise on consignment. As

Q144: Which of the following is not considered

Q145: Which of the following is a reason