Multiple Choice

Use the following information for questions 125 through 127.

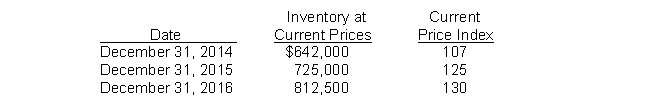

Gross Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2013. Its inventory at that date was $550,000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows:

-What is the cost of the ending inventory at December 31, 2016 under dollar-value LIFO?

A) $640,600.

B) $637,000.

C) $625,000.

D) $658,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Goods on consignment are<br>A) included in the

Q71: Dollar-value LIFO.<br>Aber Company manufactures one product. On

Q72: Nichols Company had 500 units of "Dink"

Q73: LIFO liquidations can occur frequently when using

Q74: In a period of rising prices, the

Q76: Checkers uses the periodic inventory system. For

Q77: Use the following information for 123 and

Q78: Recording purchases at net amounts.<br>Dill Co. records

Q79: When using a perpetual inventory system,<br>A) no

Q80: Both U.S. GAAP and IFRS permit the