Essay

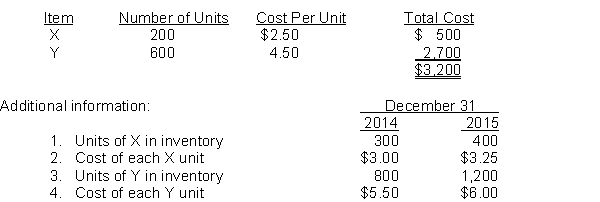

Dollar-value LIFO.Gott Company adopted the dollar-value LIFO inventory method on 12/31/13. On this date, its inventory consisted of the following items.

Instructions

(a) Compute the price index for 2014. Round to 2 decimal places.

(b) Calculate the 12/31/14 inventory. Label all numbers.

(c) Compute the price index for 2015. Round to 2 decimal places.(d) Calculate the 12/31/15 inventory. Label all numbers.

Correct Answer:

Verified

Correct Answer:

Verified

Q126: Comparison of FIFO and LIFO.<br>During periods of

Q127: Under IFRS, which of the following would

Q128: What is a LIFO reserve?<br>A) The difference

Q129: Risers Inc. reported total assets of $1,800,000

Q130: Walsh Retailers purchased merchandise with a list

Q132: If a company uses the periodic inventory

Q133: The dollar-value LIFO method measures any increases

Q134: Which of the following items should be

Q135: Assuming no beginning inventory, what can be

Q136: Wise Company adopted the dollar-value LIFO method