Multiple Choice

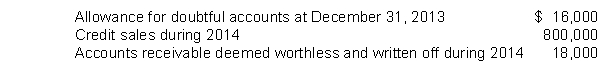

The following information is available for Murphy Company:  As a result of a review and aging of accounts receivable in early January 2015, it has been determined that an allowance for doubtful accounts of $11,000 is needed at December 31, 2014. What amount should Murphy record as "bad debt expense" for the year ended December 31, 2014?

As a result of a review and aging of accounts receivable in early January 2015, it has been determined that an allowance for doubtful accounts of $11,000 is needed at December 31, 2014. What amount should Murphy record as "bad debt expense" for the year ended December 31, 2014?

A) $9,000

B) $11,000

C) $13,000

D) $27,000

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Which of the following is included in

Q90: What is imputed interest?<br>A) Interest based on

Q91: What is the preferable presentation of accounts

Q92: In preparing its August 31, 2014 bank

Q93: Travel advances should be reported as<br>A) supplies.<br>B)

Q95: When preparing a bank reconciliation, bank credits

Q96: IFRS and U.S. IFRS are very similar

Q97: Trade receivables include notes receivable and advances

Q98: Lester Company received a seven-year zero-interest-bearing note

Q99: Both the FASB and IASB have indicated