Short Answer

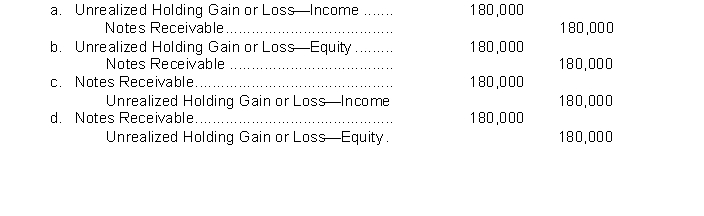

Jones Company has notes receivable that have a fair value of $570,000 and a carrying amount of $750,000. Jones decides on December 31, 2014, to use the fair value option for these recently-acquired receivables. Which of the following entries will be made on December 31, 2014 to record the unrealized holding gain/loss?

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Moon Inc assigns $3,000,000 of its accounts

Q58: How can accounting for bad debts be

Q59: Maxwell Corporation factored, with recourse, $100,000 of

Q60: Certificates of deposit are usually classified as

Q61: Wellington Corp. has outstanding accounts receivable totaling

Q63: Lankton Company has the following account balances

Q64: AG Inc. made a $15,000 sale on

Q65: Recognition of a recourse liability will make

Q66: Assuming that the ideal measure of short-term

Q67: Tresh, Inc. had the following bank reconciliation