Short Answer

Use the following information to answer Question 1 and 2.

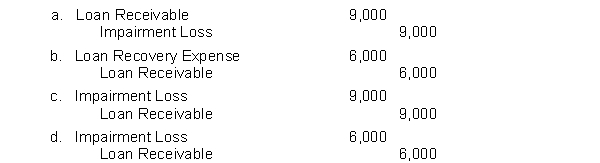

Harrison Company has a loan receivable with a carrying value of $15,000 at December 31, 2013. On January 3, 2014, the borrower, Thomas Clark Imports, declares bankruptcy, and Harrison estimates that it will collect only 60% of the loan balance.

-Which of the following entries would Harrison make to record the impairment under IFRS?

Correct Answer:

Verified

Correct Answer:

Verified

Q105: At the beginning of 2013, Gannon Company

Q106: Trade discounts are<br>A) not recorded in the

Q107: When a customer purchases merchandise inventory from

Q108: A Cash Over and Short account<br>A) is

Q109: Bank overdrafts, if material, should be<br>A) reported

Q111: David Company uses the gross method to

Q112: The accounting for cash discounts and trade

Q113: Remington Corporation had accounts receivable of $100,000

Q114: When the stated rate of interest exceeds

Q115: For a loan receivable, impairment loss is