Multiple Choice

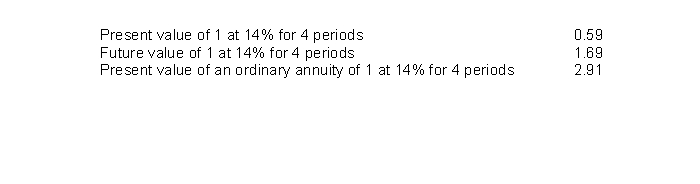

On July 1, 2014, Ed Wynne signed an agreement to operate as a franchisee of Kwik Foods, Inc., for an initial franchise fee of $600,000. Of this amount, $200,000 was paid when the agreement was signed and the balance is payable in four equal annual payments of $100,000 beginning July 1, 2015. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. Wynne's credit rating indicates that he can borrow money at 14% for a loan of this type. Information on present and future value factors is as follows:  Wynne should record the acquisition cost of the franchise on July 1, 2014 at

Wynne should record the acquisition cost of the franchise on July 1, 2014 at

A) $436,000.

B) $491,000.

C) $600,000.

D) $676,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Ethan has $160,000 to invest today at

Q39: James leases a ski chalet to his

Q40: Jeremy is in the process of purchasing

Q41: Jane wants to set aside funds to

Q42: Present value is<br>A) The value now of

Q44: Al Darby wants to withdraw $20,000 (including

Q45: Items 69 through 72 apply to the

Q46: What best describes the time value of

Q47: IFRS does not intend to issue detailed

Q48: Dunston Company will receive $300,000 in a